Blogs

10 common accounting mistakes to avoid:

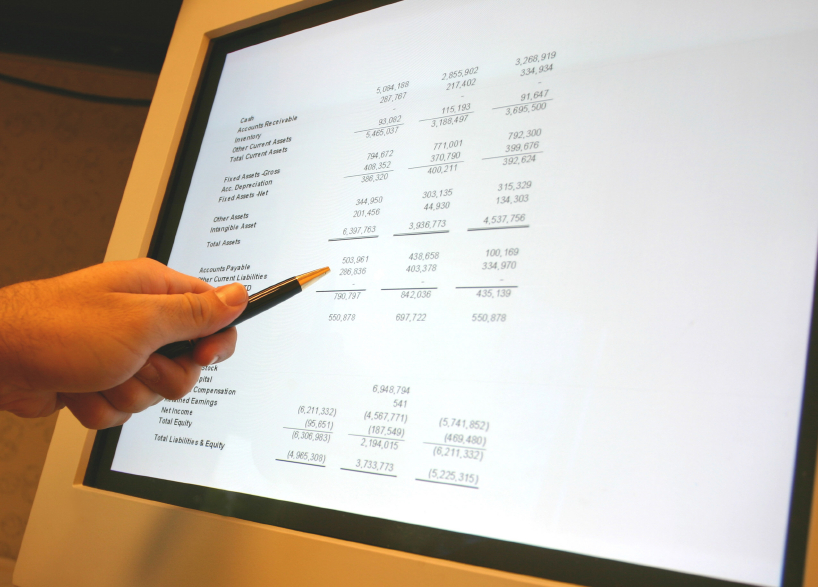

- Data Entry Errors: Mistakes in recording transactions can lead to inaccurate financial records. Double-check entries for accuracy.

- Not Reconciling Accounts: Failure to reconcile bank statements with accounting records can result in discrepancies and missed transactions.

- Ignoring Documentation: Proper documentation is crucial for auditing and compliance purposes. Keep receipts, invoices, and other financial records organized.

- Misclassification of Expenses: Assigning expenses to incorrect categories can skew financial reports and misrepresent business performance.

- Failing to Back Up Data: Data loss can be catastrophic. Regularly back up accounting data to prevent loss due to technical failures or other issues.

- Neglecting Tax Deadlines: Missing tax filing deadlines or making errors on tax returns can lead to penalties and unnecessary expenses.

- Poor Communication: Lack of communication between accounting and other departments can lead to misunderstandings and errors in financial reporting.

- Overlooking Petty Cash: Failure to track and reconcile petty cash transactions can lead to discrepancies and potential misuse of funds.

- Ignoring Internal Controls: Implementing internal controls helps prevent fraud and errors. Neglecting them can leave your business vulnerable.

- Not Seeking Professional Help When Needed: Complex accounting issues or regulatory changes may require professional expertise. Don’t hesitate to seek help when necessary.

Blogs

Bookkeeping vs. Accounting: What’s the Difference?

Many business owners use the terms bookkeeping and accounting interchangeably, but they serve different roles in supporting a business’s financial health. Understanding the difference can help business owners know when and where to seek the right type of support.

What Is Bookkeeping?

Bookkeeping focuses on recording and organizing financial transactions. This includes:

- Tracking income and expenses

- Reconciling bank accounts

- Maintaining financial records

- Categorizing transactions

Bookkeeping ensures that financial information is accurate, organized, and up to date. Without consistent bookkeeping, it becomes difficult to understand a business’s financial position.

What Is Accounting?

Accounting builds on bookkeeping by analyzing and interpreting financial data. Accounting services may include:

- Financial reporting

- Tax preparation

- Financial review and planning

- Compliance support

Accounting helps business owners understand what their financial data means and how it can inform decisions.

Why Both Matter

Bookkeeping and accounting work together to support business stability. Bookkeeping creates reliable financial records, while accounting uses those records to provide insight and ensure compliance.

Businesses that maintain accurate bookkeeping are better prepared for tax season, financial planning, and long-term growth.

When to Seek Professional Support

Professional bookkeeping and accounting services can help business owners stay organized, compliant, and confident in their financial decisions. Whether a business needs ongoing bookkeeping support or guidance with tax preparation and financial review, having reliable financial systems in place is essential.